Pet Fitness Care Market Size & Trends

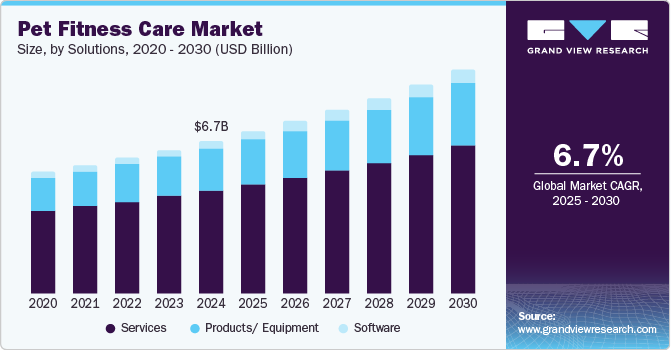

The global pet fitness care market size was valued at USD 6.65 billion in 2024 and is estimated to grow at a CAGR of 6.7% from 2025 to 2030. Some of the key growth drivers include the increasing humanization of pets, the rising prevalence of associated diseases, changing consumer demographics, pet expenditure, rapid technological innovations by industry participants, and the presence of several market players. An October 2024 article published in Telegrafi discussed the probability that pet dog owners are four times more likely to engage in sufficient physical activity compared to non-owners. The study further highlighted the benefits of dog ownership on physical health, emphasizing that dogs encourage their owners to be more active through regular exercise and walks.

As owners increasingly seek to keep their pets active and healthy, demand for fitness care products, such as fitness trackers and specialized equipment, is expected to grow lucratively. This trend reflects a broader shift towards prioritizing pet wellness, creating opportunities for businesses in the pet care industry.

Furthermore, as per a study published in August 2022 in the PLOS journal, 65.8% of the pet parents surveyed reported doing moderate exercise with their dog regularly. About 35% of respondents reported spending around 30-60 minutes per day exercising with their dogs, followed by 26% of respondents spending 15-30 minutes exercising. The increasing trend of incorporating their pets’ fitness routines into their daily exercise routines is expected to fuel the demand for pet fitness care solutions.

The increasing prevalence of diseases is a key factor driving the market growth. Some of the primary causes of fitness-related complications in pets are obesity, arthritis, hypertension, allergies, and age-related issues, among others. Increasing occurrences of these diseases may sometimes lead to a decrease in the overall fitness of the dog or cat, ultimately increasing the risk of the onset of other health complications. For example, according to data published by UK PetFood in October 2024, approximately 50% of dogs, 43% of cats, and more than 35% of other pets, like small mammals and birds, suffer from being overweight or obese. Furthermore, according to a March 2024 blog publication by Royal Canin’s VetFocus, arthritic complications like osteoarthritis (OA) have become a widespread problem in dogs & cats, affecting over 30-50% of them.

Another crucial driving factor is the rapid technological innovations by industry participants. For instance, in August 2024, Invoxia, a veterinary products innovator, launched an AI fitness tracker named Minitailz Smart Pet Tracker for pets to monitor their cardiac health and overall activity levels. This technology aims to provide pet owners with valuable insights into their pets’ fitness, promoting better health management. As awareness of pet wellness increases, such advanced products are likely to enhance the pet health and fitness solutions market. The company had previously launched Inovoxia Smart Dog Collar in 2023.

Additionally, in November 2024, Whistle provided a significant update to its Android app, Whistle 2.0, to improve performance and user experience. This new app includes swifter load times, enhanced Bluetooth synchronization, and a modernized interface. It aims to provide users with a more reliable and intuitive pet monitoring experience.

Such innovations provide pet owners with critical insights into their pets’ fitness and well-being, fostering a greater emphasis on proactive health management. As consumer awareness of pet wellness continues to grow, the demand for such innovative solutions is expected to increase, further expanding the market for pet fitness care products.

Solutions Insights

Services accounted for the highest share of more than 67% of the market in 2024, while the software segment is expected to grow at the highest CAGR over the forecast period. This is due to high service uptake and increasing adoption of varied fitness activities to maintain pet fitness. The services segment is further divided into physio assessments, agility & gym sessions, yoga classes, aquatic sessions, and outdoor fitness exercises. Amongst these, the Agility & Gym Sessions segment dominated the market in 2024. The availability of specialized fitness programs for pets, such as agility training, canine sports, and aquatic sessions, has attracted pet owners seeking structured and engaging fitness activities.

The demand for fitness products is also expected to increase notably in the coming years. For instance, the demand for equipment such as pet treadmills is rising, particularly in urban areas where outdoor space may be limited. These treadmills are designed to accommodate various pet sizes and provide controlled exercise options, making them suitable for dogs and cats. Overall, the pet fitness care market benefits from a combination of demographic, lifestyle, health, and societal trends and the increasing recognition of pets as cherished family members. This market is expected to grow in a lucrative manner as owners prioritize the health and fitness of their pets.

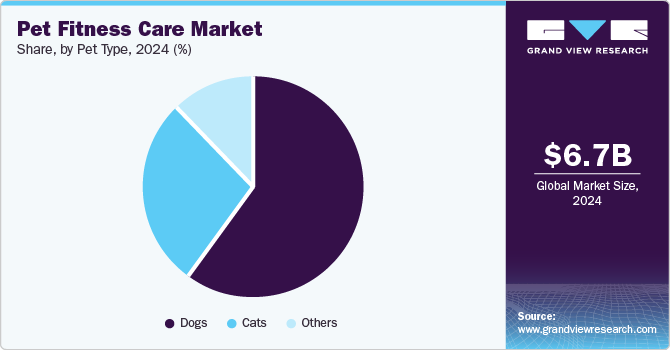

Pet Type Insights

Based on pet type, dogs dominated the market in 2024 with a share of about 60.26%. This is owing to dogs’ continued popularity as pets, the availability of a wide range of fitness products and services, and dog parents’ willingness to spend on their pets. dogPACER, for example, offers innovative treadmills for small, medium, and large canines. The cats segment is anticipated to grow the fastest, at a rate of about 7.21% from 2025 to 2030.

According to the American Veterinary Medical Association (AVMA) and internal GVR estimates, there were an estimated 95 million dogs in the U.S. in 2024. This number is projected to exceed 100 million by 2030. Similarly, the U.S. cat population will be more than 60 million in 2024. It is expected to cross 85 million by 2030. The increasing population of pet dogs and cats is thus a key factor driving the market growth.

Regional Insights

North Americapet fitness care market dominated the global industry with a share of over 41% in 2024. This is owing to the presence of key players and a high pet expenditure. Gyms For Dogs, GoPet LLC, FitPaws, Agility by Carlson, etc., are some of the key players based in the U.S. contributing to the notable market share. These companies offer diverse fitness-related products, including fitness products and training equipment, to attract a broader customer base and cater to different pet needs and preferences.

U.S. Pet Fitness Care Market Trends

The U.S. pet fitness care market is driven by the increasing expenditure on wellness care products & services. Furthermore, the country is the source of many ongoing technological innovations in the pet fitness care industry, boosting overall market growth. For instance, a February 2024 article from Bloom Tampa Bay discussed the various technological advancements that have taken place in the U.S. in the field of pet fitness and wellness sector. Some include GPS trackers, specialized fitness equipment, automated feeders, and health & fitness monitoring devices that enhance pet care and owner convenience. These technological advancements are transforming the industry by enabling better health management, safety, and overall quality of life for pets while providing pet owners with valuable insights.

Europe Pet Fitness Care Market Trends

The Europe pet fitness care market is growing due to industry participants from various countries in the region employing advanced technologies like AI and ML to enhance the existing pet fitness care solutions and attempting to capture market spaces in different countries by either introducing their leading products or launching exclusive products.

The UK pet fitness care market is growing due to the leading players in the country’s pet fitness & wellness market space constantly engaging in research and developmental activities to improve existing product offerings as per industry requirements. These domestic players also aim to increase their dominance in the global market by launching their proprietary products in other countries. For instance, UK-based Pawfit (Latsen Technology) June 2024, launched its leading product, Pawfit 3 tracker, for sales in the U.S.

The pet fitness care market in Norway is set to experience lucrative growth owing to companies employing advanced technologies like AI & ML to enhance the existing pet fitness care solutions. For instance, in February 2023, a Norway-based company launched The Lilbit smart wearable, a pet fitness and health metrics tracker. The product uses Nordic Semiconductor’s nRF9160 and nRF52811 technologies to monitor pet location and health metrics. This device is attached to any pet’s collar and utilizes machine learning to analyze movements and detect potential health issues, providing owners with valuable insights through a smartphone app. Integrating advanced connectivity features ensures reliable tracking and health monitoring, enhancing pet care management.

Asia Pacific Pet Fitness Care Market Trends

The pet fitness care market in Asia Pacific is projected to grow at the fastest CAGR of more than 7% in the coming years. As pet owners become more health-conscious and aware of the importance of their pets’ well-being, they increasingly invest in fitness equipment and accessories to keep their furry companions active and healthy. The convenience of online shopping has significantly boosted the pet fitness equipment market in the region. E-commerce platforms provide a wide range of products, allowing pet owners to easily access and purchase fitness products, such as hurdles, agility rings, etc., for their pets from the comfort of their homes.

China pet fitness care market is expected to continue its dominance over the forecast period. This can be attributed to the massive boost to pet adoption in the country. In recent years, China has experienced an overhaul of adopting different types of pets like dogs & cats. In September 2024, CNN Business reported that by the end of 2024, the pet population in many cities across the country is expected to surpass that of young children (toddlers). By the year 2030, this difference is expected to double. This naturally makes China an attractive pet wellness & fitness products & services market, driving it to lucrative growth.

Latin America Pet Fitness Care Market Trends

The pet fitness care market in Latin America is projected to grow at the second fastest growth rate over the forecast period. This is primarily due to the increasing trend of pet humanization, where owners treat pets as family members, leading to more significant investment in their health and wellness. Additionally, rising disposable incomes allow pet owners to spend more on premium products and services while growing awareness of pet obesity and related health issues fuels demand for fitness solutions. This can be highlighted by the fact that dog ownership in various countries of the region has surpassed the 50% mark when compared with the total number of households.

Brazil pet fitness care market is expected to continue its dominance over the forecast period. The country’s growth can be attributed to the increasing willingness of pet owners to spend additional capital on ensuring their pet’s fitness and health. For instance, according to an August 2024 article published in Feed Navigator, a survey conducted by Mintel inferred that 91% of the pet owners in Brazil have shown increasing willingness to invest capital into focusing on maintaining a healthy pet. This points to growing demand for specialized pet care products and services in the country, acting as a market driver.

Middle East & Africa Pet Fitness Care Market Trends

The pet fitness care market in the Middle East & Africa is growing due to the increasing penetration of pet insurance. The more pets are covered with pet insurance, the more the pet owner can spend on non-emergency expenses like fitness care. In the last few years, many pet insurance companies have emerged in the region to offer comprehensive health cost coverage for pet owners. For instance, in September 2024, Tree Digital Insurance Agency launched Saudi Arabia’s first pet insurance coverage.

South Africa pet fitness care market is set to grow at a lucrative rate due to the increasing adoption of dogs into specialized services. Dogs in the country are being actively trained for tracking, combat, and fitness. These trained dogs are utilized for specialized tasks such as tracking individuals who hunt exotic species like rhinos. For instance, since January 2024, a dog named Gooods Kulava Kutiva has been thoroughly trained to track down rhino hunters from 2025 that operate in the Kruger National Park of South Africa.

Key Pet Fitness Care Company Insights

The market is highly fragmented due to numerous companies operating in the pet fitness products, software, and services sectors. These stakeholders continuously deploy strategic initiatives to increase their market presence and share. For instance, the quality and availability of fitness facilities and specialized equipment can set businesses apart. Modern and well-maintained facilities catering to various pet needs provide a competitive advantage. Businesses have also started offering resources, workshops, or consultations educating pet owners about the importance of pet fitness and how to maintain their pets’ physical well-being to gain a competitive edge.

Moreover, innovations in pet fitness products are setting companies apart. This includes new materials, designs, or technologies that enhance the exercise experience for pets or make it more convenient for pet owners to engage in fitness activities with their animals. Go Pet LLC, for example, specializes in dog and cat treadmills and treadwheels.

Key Pet Fitness Care Companies:

The following are the leading companies in the pet fitness care market. These companies collectively hold the largest market share and dictate industry trends.

Gyms For Dogs

FitPaws

GoPet, LLC

GoodPup (Rover)

dogPACER (International Pet Group)

Tractive

Frolick Dogs

Kathy Santo Dog Training

Splash Canine Aquatic Services

Agility by Carlson

PawFit (Latsen Technology Ltd.)

FitBark

Recent Developments

In September 2024, Penn Vet Working Dog Center scientists developed a novel method to help dogs cool down after exercise, addressing the risk of overheating in working dogs. The study highlights the importance of effective cooling strategies to enhance canine performance and well-being, particularly in high-activity environments.

In July 2024, NexHA collaborated with TheHorse.com to spread awareness about equine health and fitness ahead of Equine Fitness and Conditioning Awareness Week in the U.S.

In December 2023, Bark n’ Go, a startup by a college student, launched an ambulatory gym for dogs with features like a temperature-controlled van with treadmills, allowing dogs to exercise at their own pace.

In January 2022, PetFitness launched a workout library of over 50+ fitness videos tailored to different types of pets to help them maintain proper health and fitness.

Pet Fitness Care Market Report Scope

Report Attribute

Details

The market size value in 2025

USD 7.05 billion

The revenue forecast for 2030

USD 9.76 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 – 2023

Forecast period

2025 – 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

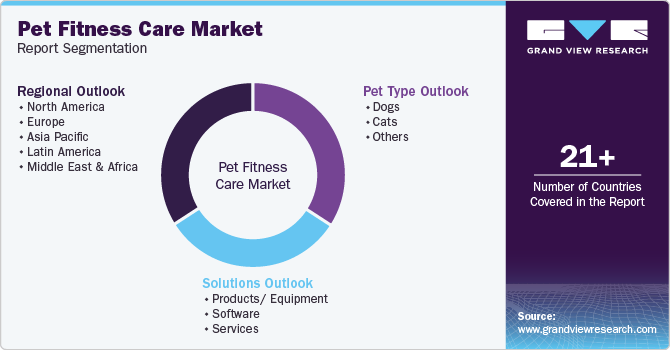

Segments covered

Solutions, pet type, region

Regions covered

North America, Europe, Asia Pacific, Latin America, MEA

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Norway; Sweden; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Gyms For Dogs; FitPaws; GoPet, LLC; GoodPup (Rover); dogPACER (International Pet Group); Tractive; Frolick Dogs; Kathy Santo Dog Training; Splash Canine Aquatic Services; Agility by Carlson; PawFit (Latsen Technology Ltd.); FitBark

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Pet Fitness Care Market Report Segmentation

This report forecasts revenue growth at the global, regional & country level and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global pet fitness care market report on the basis of solutions, pet, and region:

Solutions Outlook (Revenue, USD Million, 2018 – 2030)

Products/ Equipment

Software

Services

Pet Type Outlook (Revenue, USD Million, 2018 – 2030)

Regional Outlook (Revenue, USD Million, 2018 – 2030)

North America

Europe

Germany

UK

France

Italy

Spain

Norway

Sweden

Denmark

Rest of Europe

Asia Pacific

Japan

China

India

South Korea

Australia

Thailand

Rest of Asia Pacific

Latin America

Brazil

Argentina

Rest of Latin America

Middle East & Africa

South Africa

Saudi Arabia

UAE

Kuwait

Rest of MEA

Frequently Asked Questions About This Report

b. The global pet fitness care market size was estimated at USD 6.65 billion in 2024 and is expected to reach USD 7.05 billion in 2025.

b. The global pet fitness care market is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 9.76 billion by 2030.

b. The European market is set to be the second-largest in 2024 in terms of market share. This is owed to industry participants from various countries in the region employing advanced technologies like AI and ML to enhance the existing solutions and attempting to capture market spaces in different countries by either introducing their leading products or launching exclusive products.

b. Some key players operating in the pet fitness care market include Gyms For Dogs; FitPaws; GoPet, LLC; GoodPup (Rover); dogPACER (International Pet Group); Tractive; Frolick Dogs; Kathy Santo Dog Training; Splash Canine Aquatic Services; Agility by Carlson; PawFit (Latsen Technology Ltd.)and FitBark

b. Key factors that are driving the pet fitness care market growth include the increasing humanization of pets, the rising prevalence of associated diseases, changing consumer demographics, animal expenditure, rapid technological innovations by industry participants, and the presence of several market players.